Imagine this:

You’re at the board table.

The team’s buzzing with excitement.

“We’re launching a new product next quarter.”

And just as you're mentally noting the action points, the Managing Director turns to you:

Do we need to disclose this under Regulation 30?

A few years ago, that question would’ve made you fumble!

Because assessing materiality felt like trying to fit a square peg in a round hole

But not anymore.

Thanks to SEBI’s Industry Standards Note (ISN) under Regulation 30 of the LODR Regulations,

We’re no longer guessing.

And trust me—this time, it's a good one.

Because now?…..We’re finally comparing apples to apples.

Here’s how we apply the Industry Standards Note materiality test:

The Core Rule: When Should You Disclose?

Events or information listed in Para B – Part A of Schedule III shall now be considered material only if they satisfy either

1. the qualitative or

2. the quantitative criteria

3. or sometimes both.

Let’s study ISN, step by step.

Dear Company Secretary,

Are you spending hours scrolling SEBI and MCA sites for ..

-

Company law Amendments

-

Securities laws Amendments

-

Detailed analysis of latest case laws.

-

Checklist on various practical Topics

Well, Already 3212+ Company Secretaries get them delivered to their inbox.

You too can join our Passionate CS Email Community with the link given below

And get all of this, delivered weekly, straight to your inbox.

No noise.

No nonsense.

Just pure value…..A CS’s Commitment🤞

I. Qualitative Criteria

Ask yourself:-

a. Would not disclosing this cause confusion because of a break in continuity or change in what’s already public?

b. Would the market react significantly if this information came to light later?

👉 If yes to either—you disclose. Simple.

Legal version:

(a) the omission of such event or information is likely to result in discontinuity or alteration of event or information already available publicly; or

(b) the omission of such event or information is likely to result in significant market reaction if the said omission came to light at a later date;

Real Example:

On May 26, 2025, SEBI fined MCX ₹25 lakh for failing to disclose substantial payments made to 63 Moons Technologies.

The omission violated continuous disclosure norms—because had it been known earlier, it could’ve altered public understanding and triggered a strong market reaction.

II. Quantitative Criteria

Legal version:

If the value or the expected impact in the four ensuing quarters (including the quarter in which the event occurs if the event occurs in the first 60 days of the quarter)in terms of value of such event or information exceeds the lower of the following:

(a) two percent of turnover, as per the Company’s last audited annual consolidatedfinancial statements;

(b) two percent of net worth, as per the Company’s last audited annual consolidatedfinancial statements, except in case the arithmetic value of the net worth is negative;

(c) five percent of the average of absolute value of profit or loss after tax, as per the Company’s last three audited annual consolidated financial statements. This is where the math kicks in.

Analysis:

To check if a disclosure is material under quantitative criteria:

You test the impact of an event over the next 4 quarters (including the current quarter, if you're within the first 60 days).

And compare that to the lower of the following:-

2% of consolidated turnover

2% of consolidated net worth(unless it’s negative)

5% of average PAT(last 3 years)

Real-World Interpretation

:It’s like three doors.

Whichever opens first, you walk through that one.

🤔 So… Do All Three Apply Together?

Not necessarily.

This is where the principle of “Reddendo Singula Singulis” comes into play.

(Latin for: “match each thing with its pair.”)

Yes, it sounds Latin (because it is).

But in plain English?

Use the right metric for the right type of event.

- If the event affects profits → test against 5% PAT

- If it hits revenue → compare with **2% turnover

- If it’s about investments → use 2% net worth

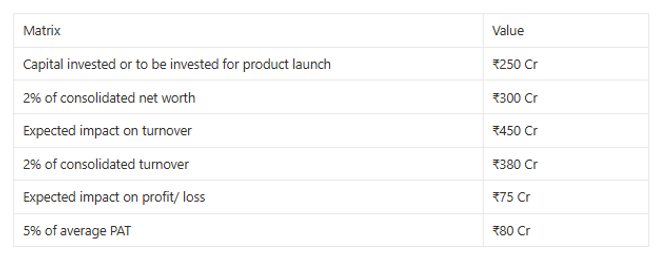

A Practical Example: Let’s take a Product Launch

Imagine this:

A listed company is about to launch a new product.

The management wants to know:

Do we disclose this under Regulation 30?

Let’s test it against ISN’s thresholds:

As per ISN, materiality threshold (Disclosure Criteria):

Lower of the below:

a. Capital invested or to be invested for product launch to 2% of consolidated net worth; or

b. Expected impact on turnover to 2% of consolidated turnover; or

c. Expected impact on profit/ loss to 5% of average PAT

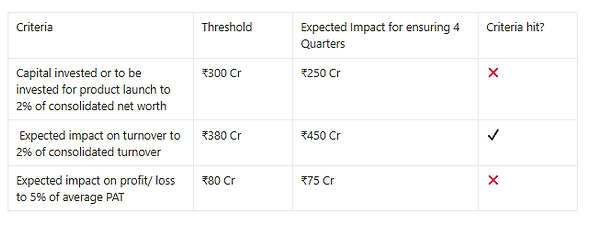

Applying the Criteria

Final Call?

Since expected turnover impact > 2% of turnover,

→ Regulation 30 disclosure is triggered.

But there’s one more thing.

If this event qualifies as UPSI (unpublished price-sensitive information), you also need to:

🔐 Create an SDD (Structured Digital Database)

Wrapping It Up

The ISN framework doesn’t just add rules.

It gives us clarity.

No more “It depends...”

No more internal debates on what’s material enough.

Now, with a few numbers and a quick checklist, your team can confidently say:

“Yes, this meets disclosure thresholds.”

“No, this doesn’t need to be filed.”

So next time you hear:

“Is this Reg 30 material?”

You won’t fumble.

You’ll smile and say:

“Let’s run the ISN test.”

In the last year alone there were around:

📌 47+ amendments by MCA

📌 60+ circulars & notifications from SEBI

📌 100+ case law rulings impacting corporate governance

That’s a lot to track.

However, already 2845+ Company Secretaries get them delivered to their inbox.

You too can join our Passionate CS Email Community with the link given below

If you found this article helpful, do like and comment…..Your engagement motivates me to share more articles!

With warm regards,

Keep Smiling,

Saeed Shaikh